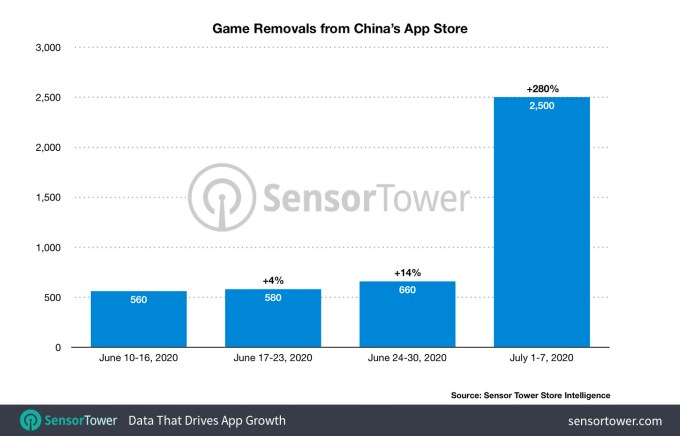

Over 2,500 mobile games have been removed from China’s App Store during the first week of July, according to a new report from app store intelligence firm Sensor Tower. The removals were expected due to a planned crackdown on unlicensed games, but this data is the first to demonstrate the impact on the app economy.

For comparison, the July figure is four times the number of games that were delisted during the first week of April, five times higher than the first week of May, and over four times higher than the first week of June.

The removals have to do with Apple’s new compliance with Chinese gaming regulations.

Apple earlier this year set a deadline of June 30 for app developers to comply with a Chinese law for mobile games, first introduced in 2016. The law requires game developers offering paid downloads or in-app purchases to get a license from one of the country’s censorship bodies, the General Administration of Press and Publication of China.

For years, iPhone game developers had skirted the law by publishing their games then waiting for their license approval. This can be a long and tedious process that could take many months, or longer if there’s a freeze underway — as in 2018. Then, the gaming industry saw a 9-month halt on the issuing of licenses as Chinese regulators reshuffled their duties to clamp down further on games containing pornography, gambling, violence and and any other content deemed inappropriate by Beijing.

Major Android app stores had already enforced the 2016 rule, but Apple’s loophole allowed a mobile gaming industry to thrive on the iPhone platform in China for years.

Apple’s decision was expected to see the removal of thousands of games from the App Store, starting July. Sensor Tower data indicates that came to pass.

However, its data is only able to capture those games that saw enough downloads to rank in the App Store’s charts, including the game subcategory charts.

Out of the 2,500+ games that were pulled, nearly 2,000 (80%) had less than 10,000 downloads since the start of 2012, the firm estimates. Together, the titles had seen a total of 133.4 million lifetime downloads.

Combined, the removed games generated $34.7 million in lifetime gross revenue, with one game accounting for more than $10 million and 6 that earned over $1 million.

Notable removals included Contract Killer Zombies 2 from Glu, Solitaire from Zynga, ASMR Slicing from Crazy Labs, Nonstop Chuck Norris from Flaregames. More recently, Hay Day from Supercell was also taken down.

The changes to the gaming market as well as the coronavirus impact on the app economy have already allowed the U.S. to reclaim the top spot in terms of iOS consumer spend in Q2. According to App Annie, the U.S. saw 30% quarter-over-quarter growth in iOS consumer spend in Q2, besting China.

The longer-term fallout from the removals may show up in Apple’s bottom line, as China has been the most lucrative mobile games market in the world, noted Sensor Tower, including on iOS. In 2019, games on China’s App Store generated an estimated $12.6 billion, or 33.2% of all global games spending on Apple’s marketplace last year, the firm said.

No comments:

Post a Comment