Most people who use AI-powered translation tools do so for commonplace, relatively unimportant tasks like understanding a single phrase or quote. Those basic services won’t do for an enterprise offering technical documents in 15 languages — but Lengoo’s custom machine translation models might just do the trick. And with a new $20M B round, they may be able to build a considerable lead.

The translation business is a big one, in the billions, and isn’t going anywhere. It’s simply too common a task to need to release a document, piece of software, or live website in multiple languages — perhaps dozens.

These days that work is done by translation agencies, which employ expert speakers to provide translation on demand at a high level of quality. The rise of machine translation as an everyday tool hasn’t affected them as much as you might think, since the occasional Portuguese user using Google’s built-in webpage translation on a Korean website is very much a niche case, and things like translating social media posts or individual sentences isn’t really something you could or would farm out to professionals.

In these familiar cases “good enough” is the rule, since the bare meaning is all anyone really wants or needs. But if you’re releasing a product in 10 different markets speaking 10 different languages, it won’t do to have the instructions, warnings, legal agreements, or technical documentation perfect in one language and merely fine in the other nine.

Lengoo started from a team working on automating that workflow between companies and translators.

“The next step to take obviously was automating the translation itself,” said CEO and founder Christopher Kränzler. “We’ll still need humans in the loop for a long time — the goal is to get the models to the level where’s they’re actually usable and the human has fewer translations to make.”

With machine learning capabilities constantly being improved, that’s not an unrealistic goal at all. Other companies have started down that road — DeepL and Lilt, for instance, which made their cases by showing major improvements over Google and Microsoft frameworks, but never claiming to remove humans from the process.

Lengoo iterates on their work by focusing on speed and specificity — that is, making a language model that integrates all the jargon, stylistic preferences, and formatting requirements of a given client. To do this they make a custom language model by training it not just with the customer’s own documents and websites, but by continually adding in feedback from the translation process itself.

“We have an automated training pipeline for the models,” said Kränzler. The more people contribute to the correction process, the faster the process gets. Eventually we get to be about three times faster than Google or DeepL.”

A new client may start with a model customized on a few thousand documents from the last couple years. But whenever the model produces text that needs to be corrected, it remembers that particular correction and integrates it with the rest of its training.

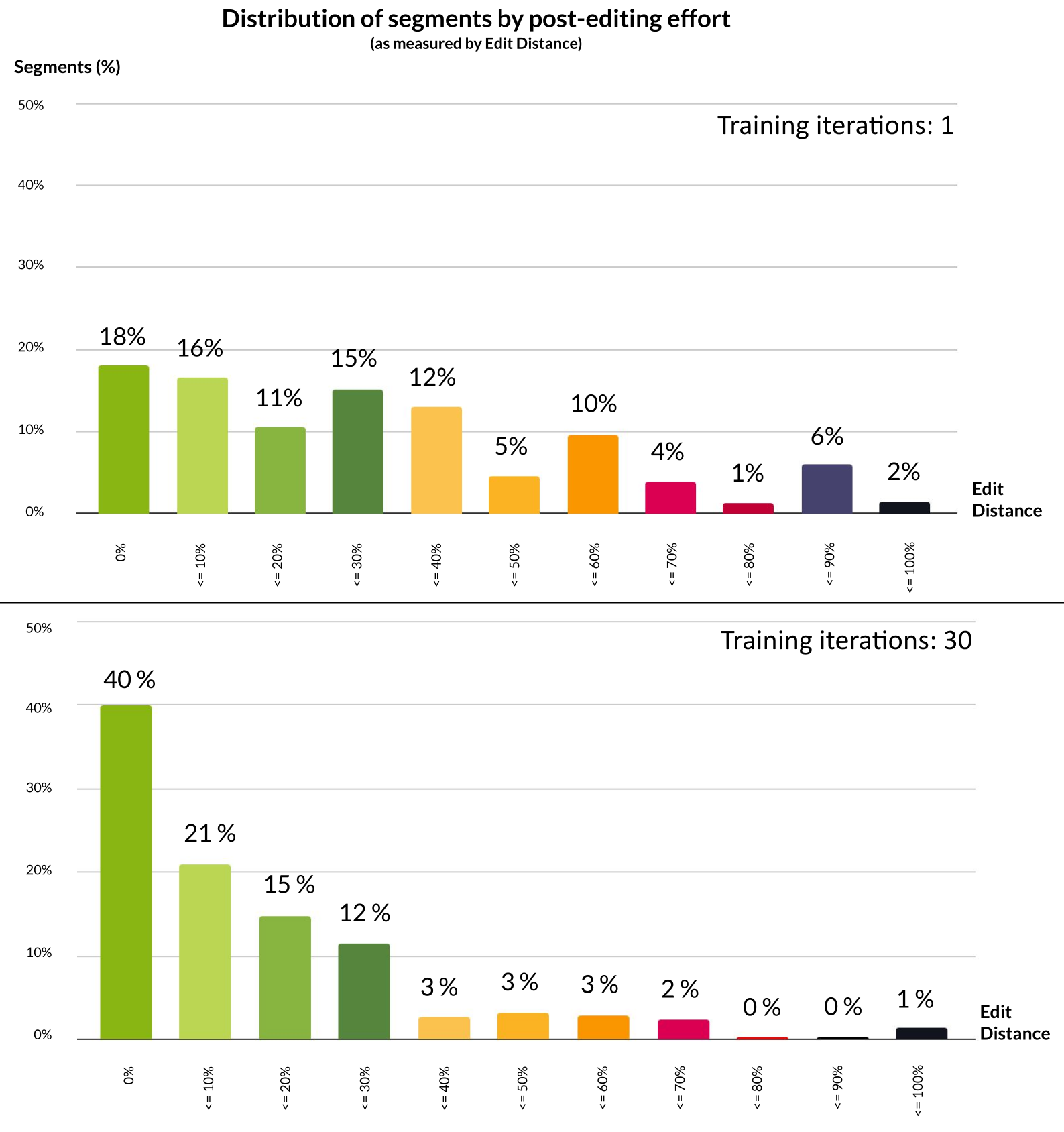

An exciting bar graph. After 30 iterations, the segments requiring no corrections have doubled, and those requiring few are much increased.

While the “quality” of a translation can be difficult to quantify objectively, in this case there’s no problem, because working as a human translator’s tool means there’s a quality check built right in. How good the translation is can be measured by “correction distance,” essentially the amount of changes the human has to make to the model’s suggested text. Fewer corrections not only means a better translation, but a faster one, meaning quality and speed both have objective metrics.

The improvements have won over customers that were leery of over-automation in the past.

“At the beginning there was resistance,” admitted Kränzler. “People turn to Google Translate for everyday translations, and they see the quality is getting better — they and DeepL have been educating the market, really. People understand now that if you do it right, machine translation works in a professional use case. A big customer may have 30, 40, 50 translators, and they each have their own style… We can make the point that we’re faster and cheaper, but also that the quality, in terms of consistency, goes up.”

Although customizing a model with a client’s data is hardly a unique approach, Lengoo seems to have built a lead over rivals and slower large companies that can’t improve their products quick enough to keep up. And they intend to solidify that lead by revamping their tech stack.

The issue is that due to relying on more or less traditional machine learning technologies, the crucial translator-AI feedback loop is limited. How quickly the model is updated depends on how much use it gets, but you’re not going to retrain a large model just to integrate a few hundred more words’ worth of content. It’s expensive computationally to retrain, so it can only be done sporadically.

But Lengoo plans to build its own, more responsive neural machine translation framework that integrates the various pipelines and processes involved. The result wouldn’t improve in real time, exactly, but would include the newest information in a much quicker and less involved way.

“Think of it as a segment by segment improvement,” said applied research lead Ahmad Taie (segments vary in size but generally are logical “chunks” of text). “You translate one segment, and by the next one, you already have the improvements made to the model.”

Making that key product feature better, faster, and easier to implement customer by customer is key to keeping clients on the hook, of course. And while there will likely be intense competition in this space, Kranzler doesn’t expect it to come from Google or any existing large companies, which tend to pursue an acquire-and-integrate approach rather than an agile development one.

As for the human expert translators, the field won’t replace them but may extend their effectiveness by, eventually, as much as an order of magnitude, which may shrink the workforce there. But if international markets continue to grow and with them the need for professional translation, they might just keep pace.

The $20M round, led by Inkef Capital will allow Lengoo to make the jump to North American markets as well as additional European ones, and integrate with more enterprise stacks. Existing investors Redalpine, Creathor Ventures, Techstars (out of which program the company originated), and angels Matthias Hilpert and Michael Schmitt all joined in the round, along with new investors Polipo Ventures and Volker Pyrtek.

No comments:

Post a Comment