The continuing saga of Lordstown Motor’s struggles as a public company took a new turn today as the electric truck manufacturer made yet more news. Bad news.

Shares of Lordstown are down sharply today after the company reported in an SEC filing that it does not have enough capital to build and launch its electric truck. Here’s the official verbiage (formatting, bolding: TechCrunch):

Since inception, the Company has been developing its flagship vehicle, the Endurance, an electric full-size pickup truck. The Company’s ability to continue as a going concern is dependent on its ability to complete the development of its electric vehicles, obtain regulatory approval, begin commercial scale production and launch the sale of such vehicles.

The Company believes that its current level of cash and cash equivalents are not sufficient to fund commercial scale production and the launch of sale of such vehicles. These conditions raise substantial doubt regarding our ability to continue as a going concern for a period of at least one year from the date of issuance of these unaudited condensed consolidated financial statements.

Now, companies that are trying to invent the future are more risky than, say, established banking concerns that are generating stable GAAP net income. I’m sure that SpaceX looked dicey at times when it was busy crashing rockets on its way to learning how to land them on drone ships.

But in the case of Lordstown’s admission that it cannot “fund commercial scale production and the launch of sale” of its Endurance pickup are fucking galling.

Why? Because when the company pitched its SPAC-led combination and public debut, it was pretty freaking confident that it would have enough cash to do so.

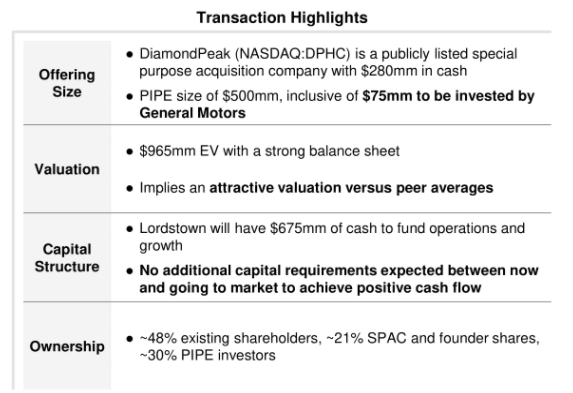

Don’t take my word for it. Here’s an excerpt from Lordstown’s investor deck:

You will note in the “Capital Structure” section that the company claimed that it would not need more funding to go to market.

Now Lordstown is pretty sure it’s going to need more money. If it’s putting the possible need in a filing, it means it.

Here’s what the company may do to solve its problems (formatting, bolding: TechCrunch):

To alleviate these conditions, management is currently evaluating various funding alternatives and may seek to raise additional funds through the issuance of equity, mezzanine or debt securities, through arrangements with strategic partners or through obtaining credit from government or financial institutions.

As we seek additional sources of financing, there can be no assurance that such financing would be available to us on favorable terms or at all. Our ability to obtain additional financing in the debt and equity capital markets is subject to several factors, including market and economic conditions, our performance and investor sentiment with respect to us and our industry.

In other words, the company is going to have to lever itself using debt, or dilute existing shareholders through the sale of equity, and Lordstown can’t promise that it will be able to do either “on favorable terms or at all.”

What we’re seeing here is the difference between SEC filings, which are no-bullshit zones, and SPAC decks, which are business propaganda. Shares of Lordstown fell more than 16% during regular trading, and another 6.9% in after-hours trading, as of the time of writing.

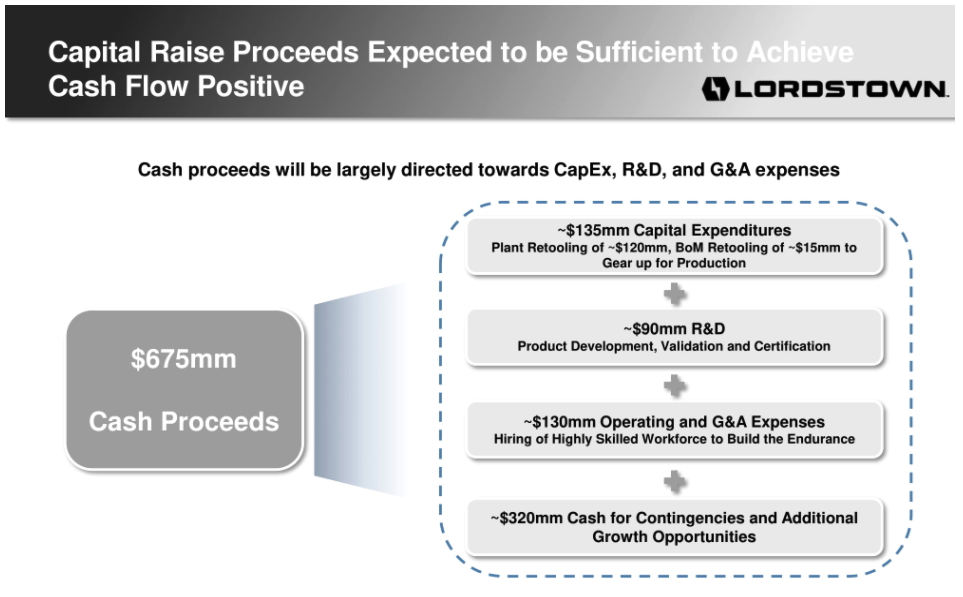

This mess from the company that put out this diagram in its investor deck:

In separate news, TechCrunch received an invite to a media availability to visit Lordstown’s operations in May, which included a note that the company “look[s] forward to opening [its] doors and showing you the latest progress from Lordstown Motors as [it] prepare[s] for the beginning of production in late September.” In a new missive sent today concerning the same event, the production timeline was not present.

So, yeah, maybe don’t trust SPAC decks much, if at all.

No comments:

Post a Comment